Articles and Features

How the Crypto Art Boom is Changing the Art Market

By Adam Hencz

“Everybody sees it, only one owns it”.

One must live completely cut off from the rest of the world, not to have heard about the ongoing Crypto art boom that has undoubtedly turned the art world on its head over the past few months. The first major auction house to offer a fully-digital work of art for sale, Christie’s move into the emerging crypto art market to offer an NFT (Non-Fungible Token) proved to be an unimaginable success as the artwork sold for over $69 million on March 11, 2021. The artist, Mike Winkelmann, who goes by the name Beeple, is now the third most valuable living artist in terms of auction prices, after David Hockney and Jeff Koons, shared Christie’s in a tweet briefly after the auction. But the digital marketplace and the technology behind has already been at artists’ disposal for years now, we retrace the rise of NFTs, from the beginnings to the recent, unprecedented success.

What is crypto art?

The crypto art market relies on the transfer of unique NFT tokens, one of the earliest approaches to utilise blockchain technology in order to identify, uniquely represent and trade otherwise easily-reproducible digital items.

NFTs first gained mainstream awareness in 2017 due to the success of encrypted collectibles like the blockchain game CryptoKitties which allowed players to purchase, collect, breed and sell virtual cats. An individual piece of crypto art is in the same way distinguished from other, interchangeable crypto assets, including currencies like Bitcoin and Ethereum, by its singularity. It is eventually a record on the blockchain that encodes its provenance, a so-called smart contract that defines the conditions of its transfer. These items, in most cases represent digital assets like images, gifs, videos, audio files, and various digital items. Their authentications in all instances identify just one original. The true power of NFTs rely on their ability to fully transfer concepts like ownership and compensation from the physical and economic world to the digital realm. While a vast amount of digital copies might be available online or elsewhere, only one individual can claim ownership to the asset – technically the NFT – that is behind it.

Since then, we have seen NFT use cases evolve to include an emerging ecosystem of artists that are using new platforms like SuperRare, Nifty Gateway or Rarible to tokenize their artwork and sell them to a new generation of art collectors. These platforms have been described to be lowering the barriers to entry for artists to enter the market and to trade tokens with collectors, that represent digital artworks. On the other hand, the competition is so fierce, that only artists and creators already bearing a well-established reputation are making it to the headlines and cashing in on the opportunity. For example earlier this month, Canadian musician Grimes dropped $5.8 million worth of her NFT crypto art that was sold in less than 20 minutes. Meanwhile, a group of financial traders under the moniker of Injective Protocol bought and torched Banksy’s $95,000 Morons (White) (2006) to transform it into a possibly more valuable NFT artwork as well as to “inspire technology enthusiasts and artists.” A few days later, Twitter founder Jack Dorsey decided to auction the world’s first-ever tweet off as an NFT with a high bid already $2.5 million. In Beijing, the world’s first NFT art exhibition is about to take place as the UCCA Center for Contemporary Art is staging the first museum show dedicated to crypto art.

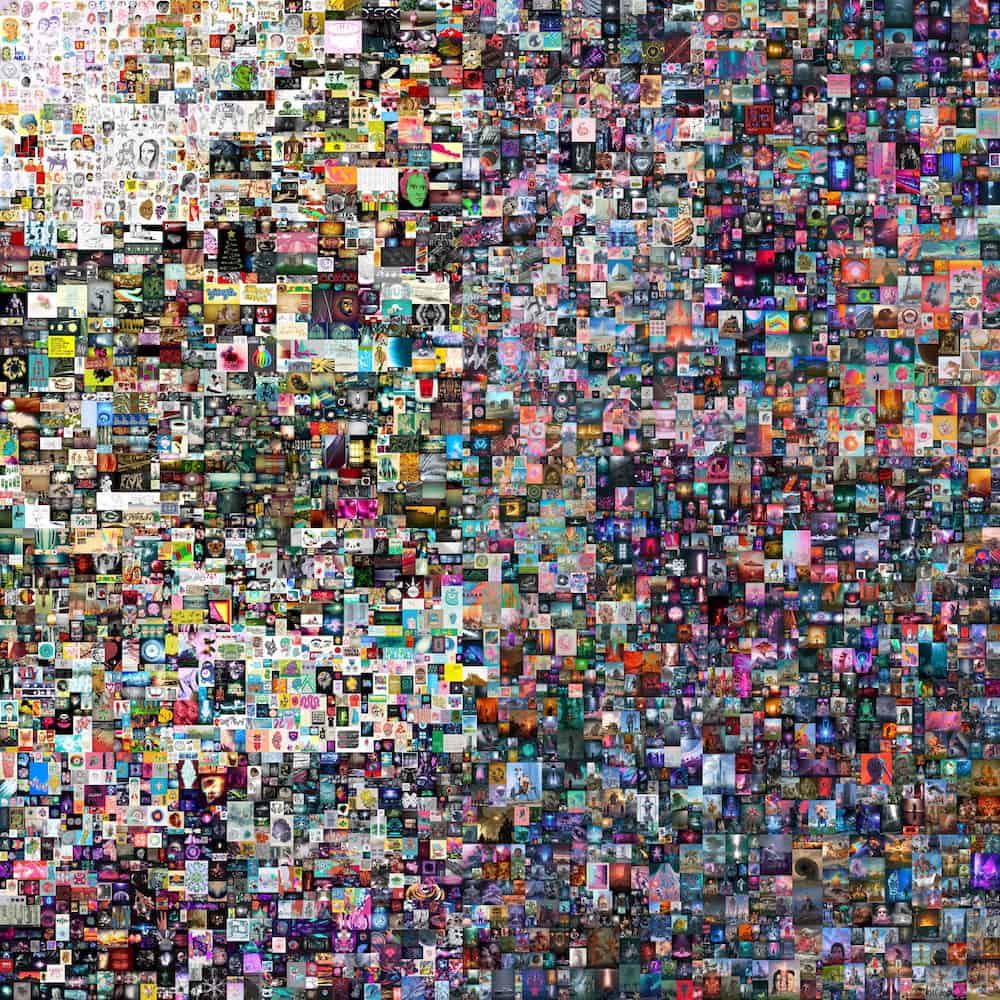

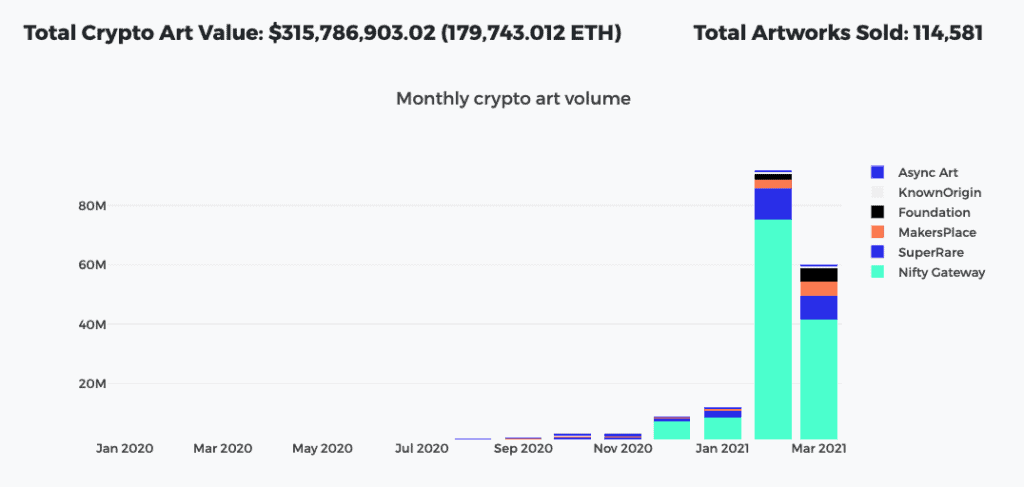

The Beeple sale is unquestionably a turning point for the crypto art market that has gone from only a few thousand dollars to over $300 million of crypto art sold in the past year according to cryptoart.io. The unique edition of Beeple’s Everydays: The First 5000 Days (2021) digital collage that came to Christie’s historic auction, is comprised of drawings responding to current events, incorporating surreal scenes of politicians like Donald Trump and Mao Zedong and cartoons featuring Pokémon, Mickey Mouse and Buzz Lightyear. The Everydays project dates back to May 1, 2007, when Winkelmann set a goal to create and publish a new artwork every day and has been unbrokenly doing so since then. His recent success doesn’t come out of the blue as 21 original works from this series already generated $3.5 million in December 2020 in an auction with crypto art platform Nifty Gateway.

The dark side of the market

NFTs’ ability to confer uniqueness has led to a boom in digital art’s collectibility. Before, anyone could replicate an image an infinite number of times, making it impossible to create the perception of scarcity or value. There was no way, in other words, to build a market, and NFTs offered a solution. But in the meantime, there are many potential problems on the horizon for which no ready answers seem yet to exist.

While the crypto economy thrives on rhetoric about freedom and democratization, the underlying technology is extremely complex and highly dependent on the physical infrastructure that is scattered around the globe. Besides, when it comes to ownership, an important fact is often omitted when dealing with NFTs that is, owning an NFT token basically means just owning an inventory number and not the asset itself. The token points to the digital file’s address on a storage site that is independent from any blockchain. What if this more vulnerable file system is hacked, or the businesses running them somehow go bankrupt and sell them off? Could there then be NFTs shorn from their art? Where is the trust in the $300 million crypto art market?

What is more, with no travel involved, and mostly digital distribution, the new market looks like it has the potential to become a sustainable practice for the art world, although the underlying algorithms are very compute-intensive and generate unreasonable environmental and ecological costs. “I do understand why they want to surf the wave because they could be set for life,” Joanie Lemercier told Wired Magazine in an interview. The French artist known for his perception-bending light sculptures, after learning about his carbon footprint, cancelled his planned drops worth $200,000 and took on a new role as a climate activist. What it takes now is to educate ourselves about this new disruptive market’s mechanism and to understand the prime intentions behind the boom. Members of the crypto art ecosystem find themselves called to make active choices in their community and be present to drive the momentum towards a sustainable and meaningful future, otherwise it all might swiftly get close to becoming our new internet wasteland.

Relevant sources to learn more

What Are NFTs and How Do They Work?

NFTs Are Everywhere: Here’s What to Know Right Now About the Digital Trend and Where It’s Headed Next

Kenny Schachter’s Handy Glossary of NFT Terms for Newbie Crypto-Art Converts

The Unreasonable Ecological Cost of #CryptoArt

Why I’m Collecting Black Crypto Art

Browse the major crypto art marketplaces

SuperRare

Nifty Gateway

Rarible

OpenSea

Or dive into the data behind the crypto art market

More about the art market on Artland Magazine: Meet the Next Gen Collectors: Who Are They and How Are They Changing the art market?