Articles and Features

Going Once, Going Twice, Sold!

Art Auctions Through History

As the art market has grown into a multi-billion-dollar global industry – with an annual turnover of about $60 billion – art auctions remain one of its focal points, to the extent that not even the current global pandemic has upended them. On the contrary, newspapers keep reporting unprecedented sale records; suffice it to mention the NFT artwork by Beeple sold for a whopping $69 Million at Christie’s – which has made him the third most expensive living artist at auction and has represented an unequalled sale of a digital artwork.

The Art Auction Model

Pillar of the secondary market – the primary market concerns works first sold after their production, whether the secondary market deals with any subsequent re-sales – auctions establish benchmark prices and represent a long-standing buying and selling formula involving a succession of increasing bids or offers on private properties by potential purchasers until the highest, ultimate bid is accepted by the auctioneer; the English word ‘auction’ is in fact derived from the Latin augere: ‘to increase’.

This model creates a highly allured and tense sale environment which, combined with time pressure, generates excitement and fierce competition amongst bidders, ultimately resulting in sky-rocketing prices. Scientific studies have even documented a phenomenon known as ‘auction fever’ typical of adrenaline-filled social occasions.

Although deeply rooted in tradition, the art auction model is progressively adapting to the 21st-century general digital direction; we retrace its history, from its ancient origins to glamorous developments in modern times and the recent online breakthrough.

Art Auctions: the Origins

The history of auctions goes back to ancient Greece, having been recorded as early as 500 BC by Herodotus, who documented auctions of women for marriage and slaves. The first evidence of art auctions, however, dates to Roman times, when sales were usually held either to resolve cases of insolvency or to dispose of war booty and slaves.

Never really popular in Asia, the practice persisted in Europe until the early period of Christianity but fell into disuse by the Middle Ages.

It was not until the 17th century that art auctions were brought on the map again as the emergence of a collector-base within the mercantile middle-class of Flanders, Holland, and some parts of Italy engendered the flourishing of the market. Newspapers began reporting on the auctioning of artworks in the coffeehouses and taverns of London and Paris, and in 1674 the first auction house, Stockholms Auktionsverk, opened its doors for business in Stockholm.

Modern Times

The mid-1700s saw the beginning of the modern history of auctions with three major events: the sale at auction of a major art collection of the time, belonging to Edward Earl of Oxford, and the establishment in London of those which would become the two largest auction houses in the world: Sotheby’s in 1744, followed by Christie’s in 1766.

The art market expanded exponentially over the nineteenth century and, in the wake of colonialism and emerging global trade, especially African and Asian artefacts, from lacquers to porcelains, came under the hammer along with Old masters as well as works by living artists. Moreover, after the end of the Civil War, early American industrialists joined European collectors in the race for the highest bid until the Great Depression first, and then World War II marked the end of an era with a profound effect on the art market.

Art as an Asset: the Rise of Contemporary Art

While East Asian countries such as China, Japan, and Korea developed important local art markets following World War II, the European market was slow to recover and remained largely dominated by private dealers until major changes occurred in regards both to the intrinsic characteristics of art auctions and the general shifting in taste. On the one hand, following Sotheby’s innovative marketing strategy – abreast of the auction house’s expansion across the ocean and the diversification of collectables – art auctions, once rather tedious events for professionals, become glittering celebrity-filled evening events. The auction room turned into an arena for social competition at the rhythm of the so-called ‘auction chant’, the frantic repetition of numbers and words spoken by auctioneers. Simultaneously, Sotheby’s invested in new technology, introducing telephone bidding and satellite links.

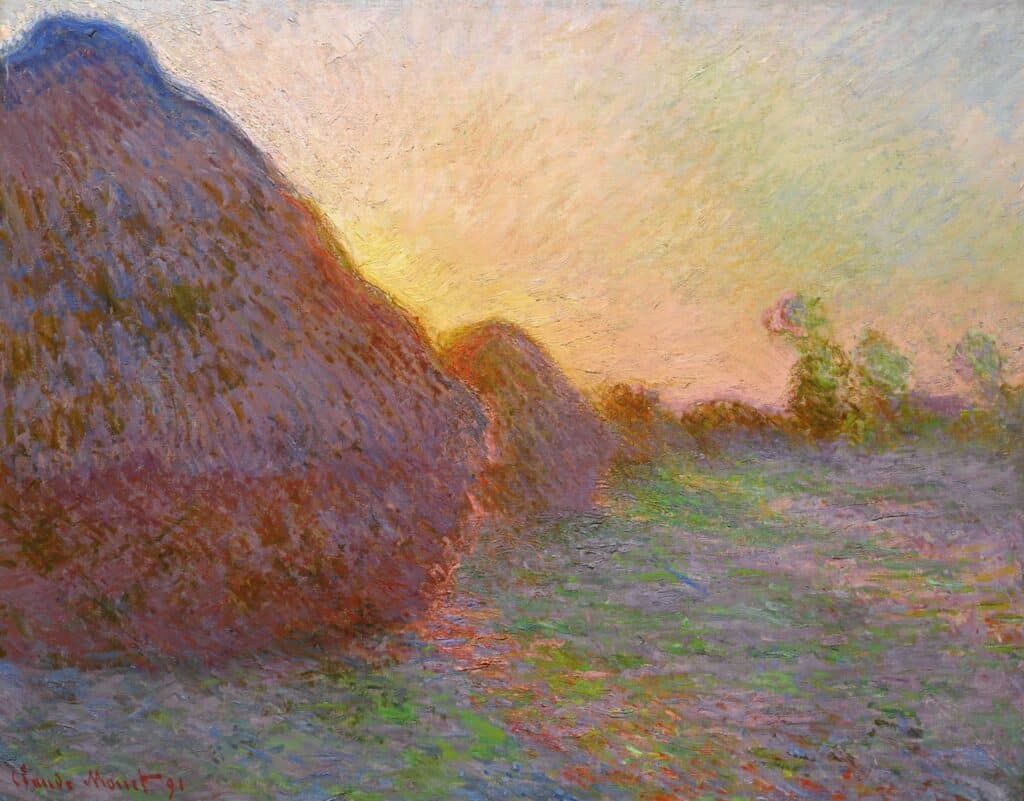

On the other hand, contemporary art triumphed in the market and names such as Monet, Van Gogh, Picasso, but also Pollock and Warhol started replacing the Old Masters and setting new price records.

As auction houses re-invented themselves as luxury goods companies, in the 1980s art developed as an alternative investment, shaping the market by trends in the broader economy. Investors started looking at the financial benefits of collecting art and Japanese buyers, prompted by the revaluation of the yen in 1985, played a fundamental role in the boom of the market.

In the 1990s, the patronage of British collector Charles Saatchi, followed by the opening of Tate Modern in 2000, reinforced the rise of contemporary artists (suffice it to mention the YBAs), setting an enduring trend. In fact, although to date the most expensive item sold at auction is Leonardo da Vinci’s Salvator Mundi, boasting $450.3 million in 2017, the growing popularity of contemporary artists does not seem to be coming to a halt.

Going Online: Artland Collector Auctions

Although major players in the luxury market are still somewhat hesitant to abandon physical events in favour of online selling channels out of fear of diluting exclusivity, the market – art auctions included – is increasingly, and inevitably, going digital in every aspect, from the nature of auctioned artworks to currencies used to pay for items at auction, to selling channels, ultimately offering a modern way of buying and collecting art.

In this light, Artland Collector Auctions represent a great opportunity for art lovers to grow their collection by acquiring original works from the world’s leading community of private collectors, with no commission and no hidden fees.

Collectors can forget eye-watering prices without forgoing the artworks’ uniqueness and vetted quality as well as the subtle pleasure of an adrenaline rush.

The bidding at Artland Collector Auction No. 2 has started this week and ends March 30th. A wide selection of works at auction, from Danish favourite HuskMitNavn to internationally renowned Eddie Martinez, can be also experienced through a virtual reality exhibition.

Relevant sources to learn more

Artland Collector Auction No.2

Auction Terminology: A Glossary

Read about Banksy’s shredded painting during a Sotheby’s auction